Plastic Packaging Tax – What do manufacturers need to know?

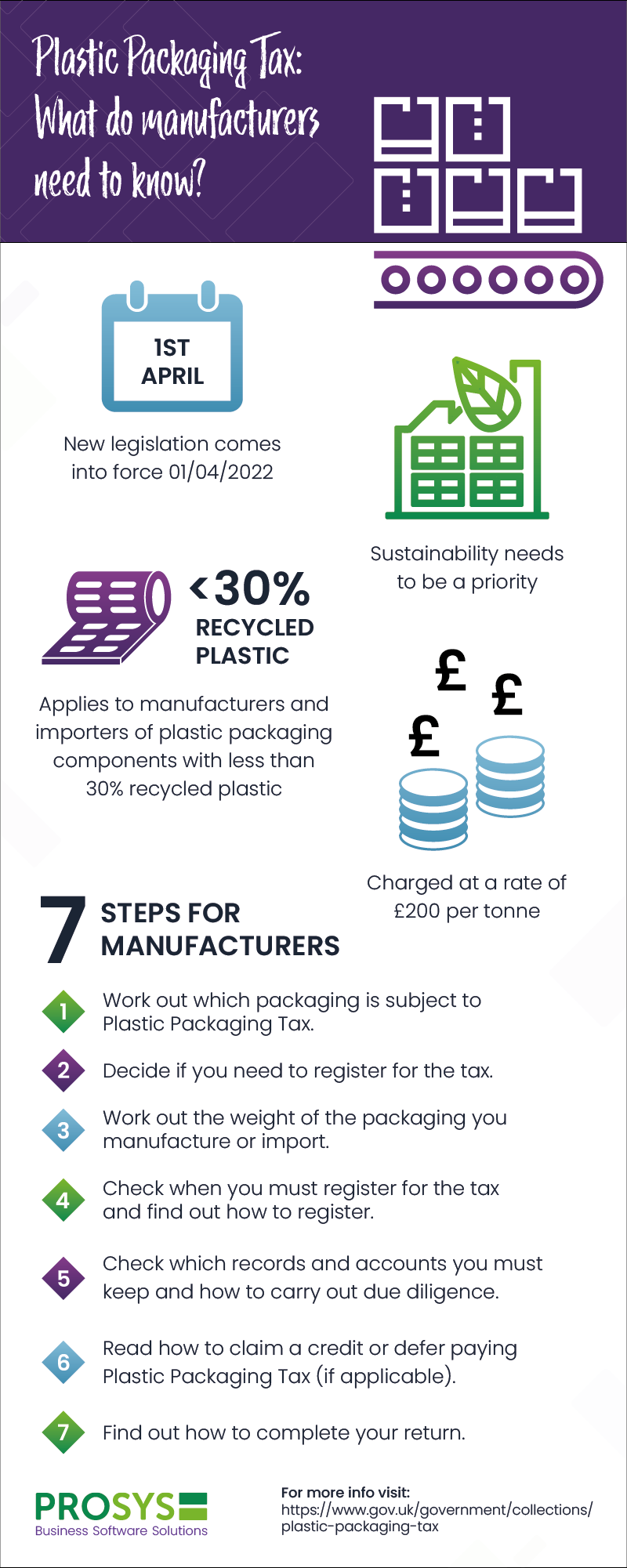

A new tax, Plastic Packaging Tax, is coming into force from the 1st April 2022 and will affect manufacturers and importers of plastic packaging components which contain less than 30% recycled plastic. If you aren’t already aware of the details now is the time to get up to speed!

The background – Why is this important?

We’re all well aware of the climate crisis and the impact our actions have on the environment, and as individuals and businesses, we’re more conscious of how we can make positive changes. The new Plastic Packaging Tax is just one part of the UK Government’s environmental and sustainability planning to encourage businesses to contribute to a cleaner world.

The plastics industry is a major component of the UK manufacturing sector. Plastic products are used in practically every industrial and distributive sector and many key manufacturing sectors are almost wholly reliant on the plastics supply chain, including construction, automotive, aerospace, oil and gas, water, energy, agriculture, healthcare and food delivery.

Despite having many uses, less than a third of all plastic in the UK is recycled (PlasticsEurope, 2020). Plastic packaging is typically only used for a short period and then disposed of. It accounts for 44% of plastic used in the UK (British Plastics Federation, 2016) and 67% of plastic waste (WWF, 2018).

Using new plastic requires unnecessary resource extraction and processing, with higher energy use and emissions than using recycled material. It also results in significant amounts of additional plastic waste on the market, which is generally sent to landfills or incinerated.

10 million tons of plastic is dumped in our oceans annually. That’s equivalent to a bin lorry full every minute!

(Plastic Oceans International, 2021)

The purpose of the new Plastic Packaging Tax is to provide a clear economic incentive for businesses to use recycled material in the production of plastic packaging. Greater demand for recycled plastic will stimulate increased levels of collection and recycling of plastic waste.

What do I need to know to comply with the new Plastic Packaging Tax?

The good news for smaller manufacturers is there’s a threshold of 10 tonnes a year. So, if you manufacture or import packaging under this weight across a 12-month rolling period, the tax won’t apply.

We’ve compiled all the key facts and the 7 steps manufacturers need to take to stay compliant in this handy infographic:

Download the infographic in PDF

What do I need to do next?

All the resources mentioned in the 7 steps for manufacturers can be found on the UK Government website here, including how to work out which packaging is subject to Plastic Packaging Tax and how to calculate the weight of the packaging you manufacture or import, as well as how to complete your tax return.

You may need to make changes ahead of the tax introduction, so you must understand the detail of the legislation and whether it applies to your business. It is also worth noting that if your suppliers are subject to this tax, you could see potential price increases passed down.

If you don’t already use over 30% recycled plastic, you can access lots of useful advice and resources on the British Plastics Federation website that will enable you to move to more sustainable packaging.