VAT domestic reverse charge for construction: what do you need to know?

From 1 March 2021 the domestic VAT reverse charge must be used for most supplies of building and construction services.

The charge applies to standard and reduced-rate VAT services:

- for individuals or businesses who are registered for VAT in the UK

- reported within the Construction Industry Scheme

The VAT domestic reverse charge for building and construction services affects the supply of certain kinds of construction services in the UK. Both contractors and subcontractors are affected.

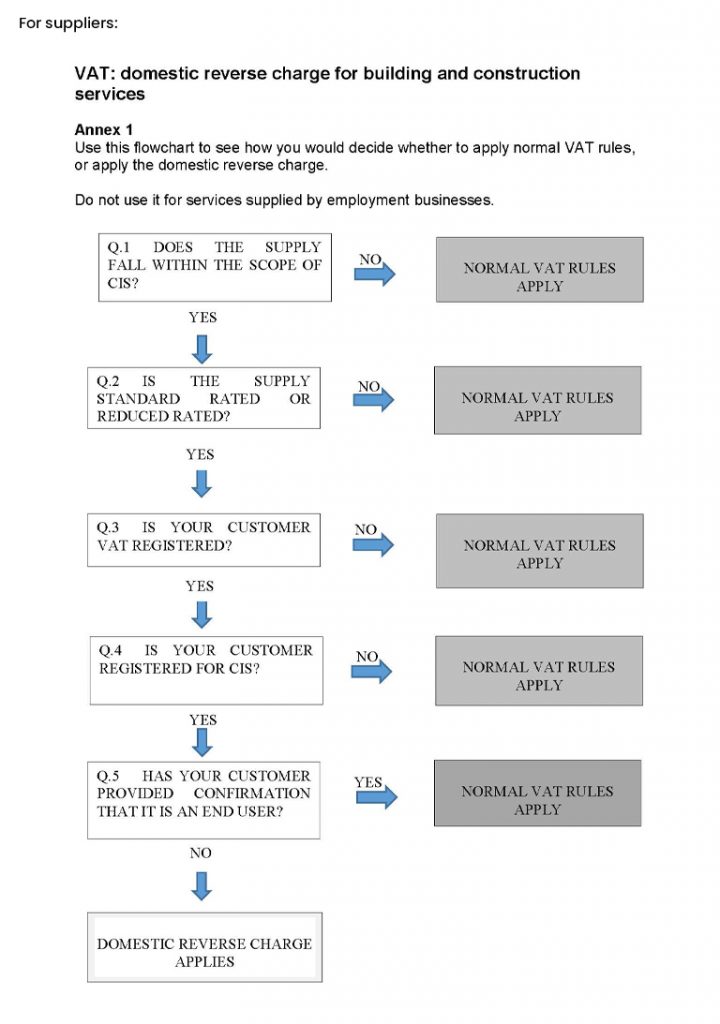

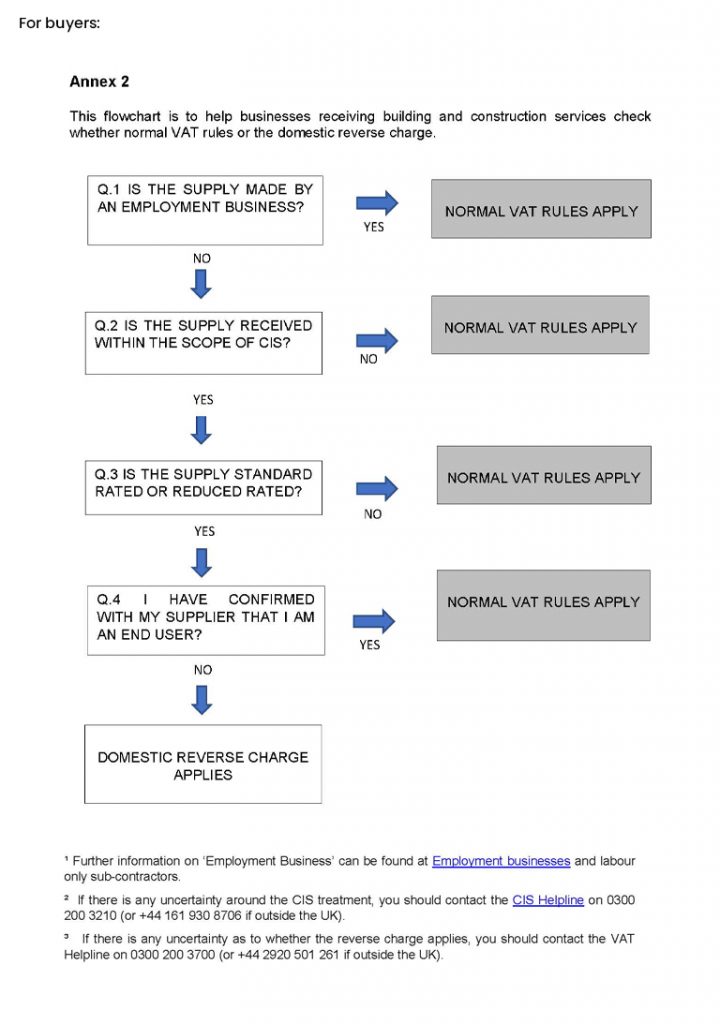

The VAT domestic reverse charge applies to a very broad section of businesses involved in property development, even those who may not typically consider themselves to be construction companies. If you’re not sure if this applies to your business, you can find out more using the Government’s flowcharts:

The VAT reverse charge applies to all jobs completed on or after 1 March 2021. However, it could apply to work that was commenced before this date but completed afterwards.

If you have any questions about the VAT domestic reverse charge for construction, an on-demand webinar recording from the Government is available which covers all the necessary information in detail.

You can access this Government webinar here: register.gotowebinar.com/recording/construction-reverse-charge